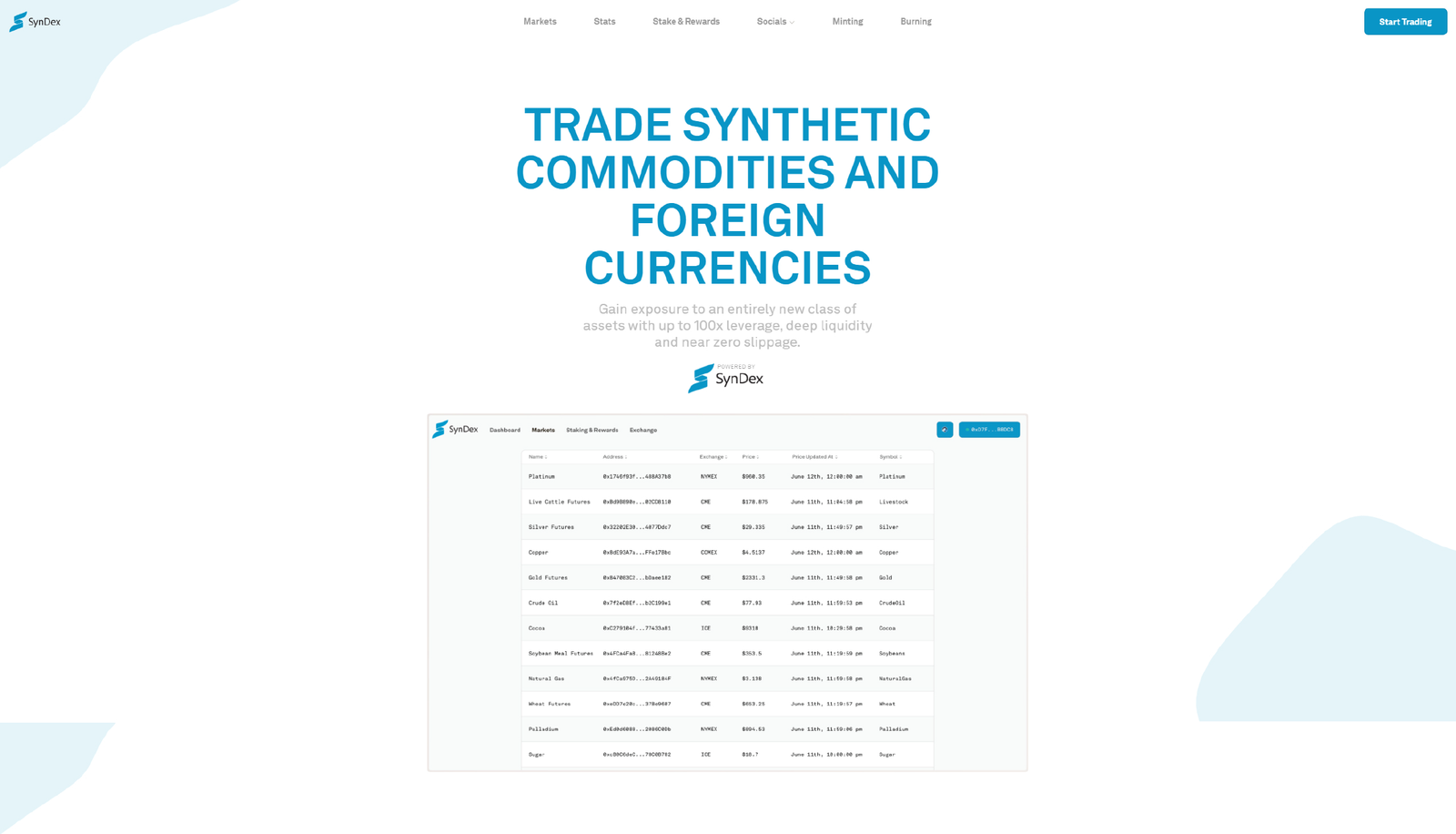

We addressed these challenges by developing Syndex Protocol, a decentralized liquidity protocol built on Arbitrum Layer 2, leveraging Ethereum’s security while significantly reducing transaction costs. The solution includes:

• Synthetic Asset Collateralization: A staking mechanism for SFCX tokens to back synthetic assets (Synths), ensuring deep liquidity and maintaining real value.

• Smart Contracts (Solidity): Gas-optimized smart contracts for staking and collateralization, ensuring security and reducing transaction overhead.

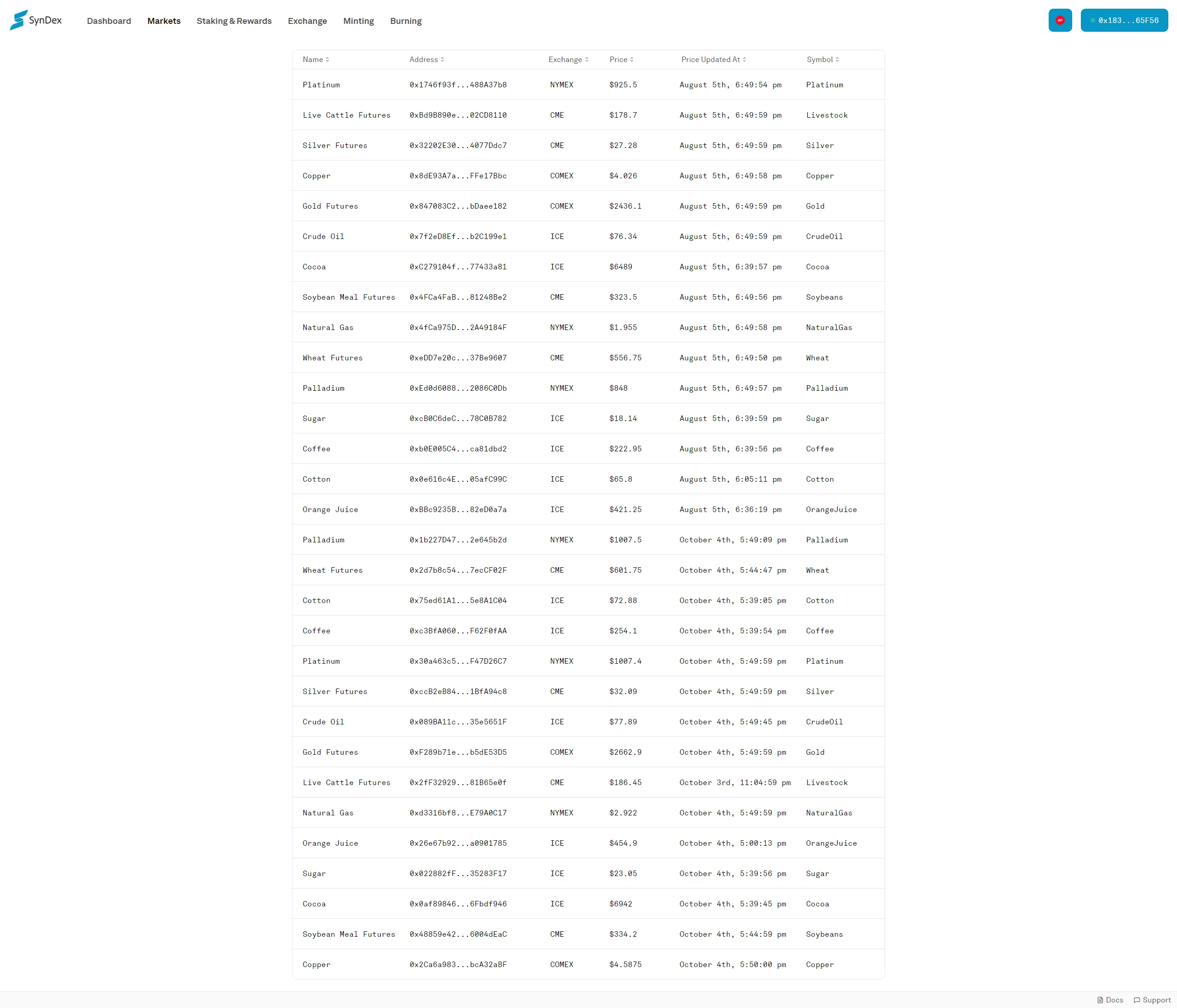

• Oracle Integration: Integration of decentralized oracle networks like Chainlink and Pyth, providing real-time price feeds for synthetic assets to ensure accurate and up-to-date trading data.

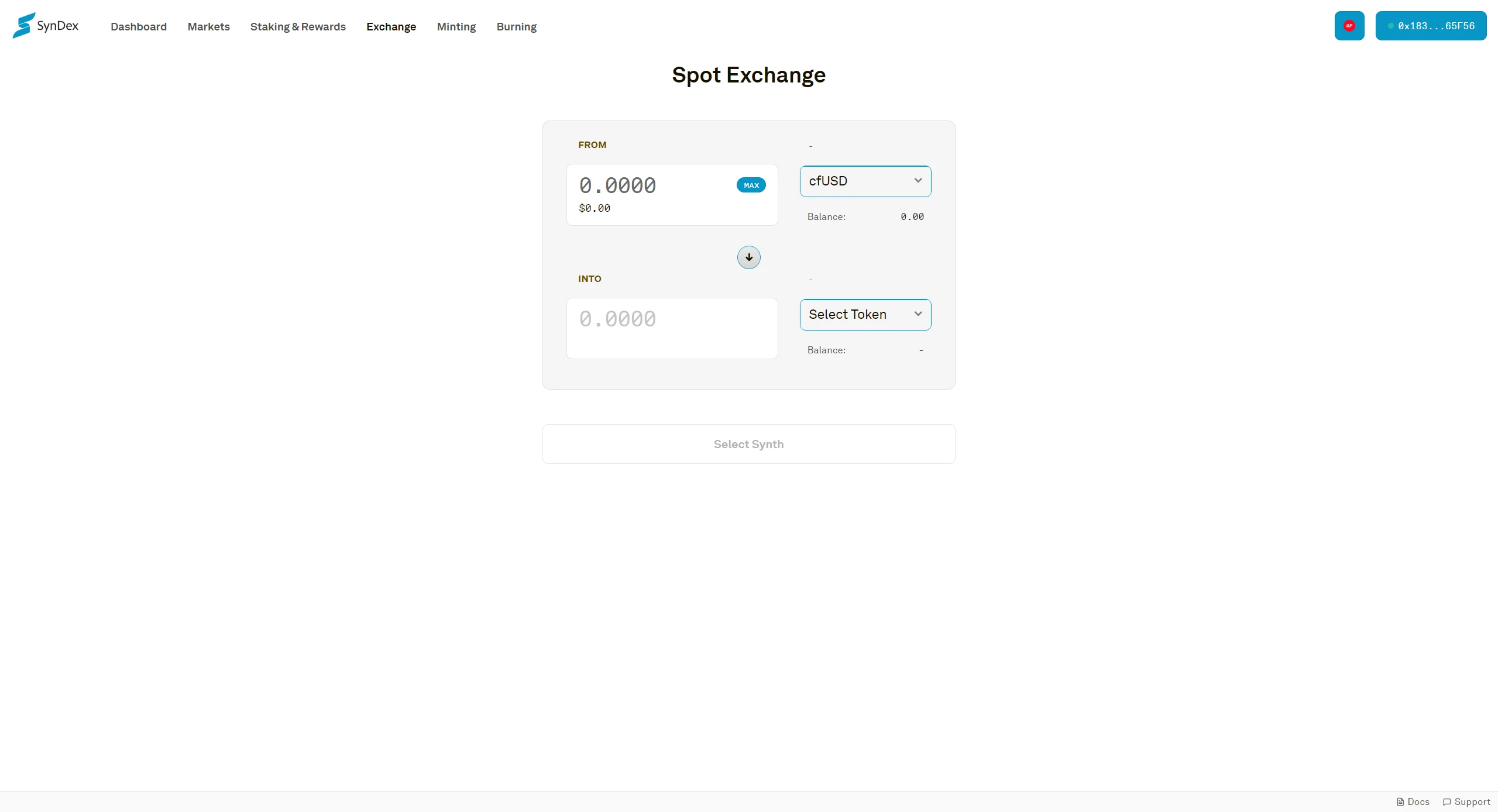

• Staking and Liquidity Mechanism: A user-friendly staking interface developed using React.js and Web3.js, allowing users to stake SFCX tokens and collateralize synthetic assets like cfUSD and cfGold, supporting spot trading at real-time prices.

• Backend Architecture: A robust backend using Node.js and Express.js, managing staking data, real-time price updates, and user interactions. MongoDB is utilized to track transactional data and staking rewards, ensuring smooth performance.

• Layer 2 Integration: By using Arbitrum, we reduced transaction fees and enabled fast, cost-effective transactions while benefiting from Ethereum’s security.

This system removes the need for counterparties, providing continuous, scalable, and reliable liquidity. With Syndex, DeFi platforms no longer face fragmented liquidity pools, and traders can confidently execute trades without concerns over slippage or liquidity shortfalls.